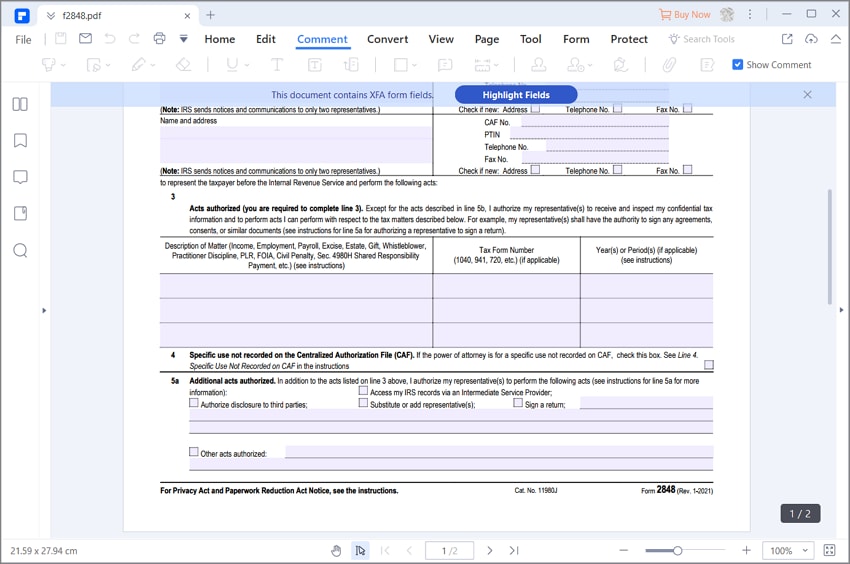

With Form 2848, you can nominate any individual or a firm to assist you with your taxes. When you appoint an agent to file your taxes, you can protect your identity because you are not giving out your sensitive information. Conclusionįorm 2848 is a critical document in taxpayer identity protection. – Risk Of Identity Theft – There is a risk that the individual or the firm you appoint as your tax agent could misuse your sensitive information and commit identity theft. – Risk Of Errors – When you appoint an agent to file your taxes, there is a risk that the information that is filed with the IRS is incorrect. – Less Privacy – When you appoint an agent to file your taxes, the individual or the firm you appoint has access to your sensitive information. – Easy To Amend – If you have forgotten to appoint an individual as your tax agent, you can amend Form 2848. – Convenient – With Form 2848, you can appoint a tax agent to assist you anytime and anywhere. –Įasy To Revoke – You can revoke your agent’s authority anytime. – Flexible – The individual or the firm you appoint as your tax agent can either transmit your tax information to the IRS or get your tax details from you and then transmit the information to the IRS on your behalf. – Easy To Use – With Form 2848, you can appoint any individual or a firm to assist you with your taxes. – Protecting Your Identity – By appointing an agent, you can protect your identity because you are not giving out your sensitive information. – Other – You can appoint any other person as your agent to assist you with your taxes. – Representative – You can appoint an individual confirmed by the court to act on your behalf.

Form 2848 irss professional#

– Tax professional – You can appoint any professional, such as an attorney or an accountant, with a degree in accounting or law to assist you with your taxes. Tax preparers are individuals or firms licensed by the IRS and authorized to represent taxpayers. – Tax preparer – You can appoint a tax preparer to assist you with your taxes. – Select “Form 2848” from the list of available IRS forms. – Click on the “Forms on Paper” option to view a list of available IRS forms. – Select “Tax Tools” from the drop-down menu.

Form 2848 irss download#

Follow these steps to download Form 2848. You can also file Form 2848 by downloading it from the IRS website. On the next page, click the “Select an agent to log into my account” option and follow the steps to appoint your tax agent. Visit the IRS website and click on the “Begin Your Taxes” option. You can protect your identity by appointing an agent to file your taxes because you are not giving out your sensitive information. Form 2848 is a critical document in taxpayer identity protection. However, the agent’s access to your information is limited to what is stated on Form 2848. They can also transmit data to the IRS on your behalf. These agents have access to your login information and can log in to your account to view information such as your W-2, 1099, and other tax forms stored in your account. When you appoint an individual or a firm as your tax agent, you give them access to sensitive information. If a taxpayer needs assistance filing taxes, such as an individual with a disability or an older adult who is not comfortable with computers.

0 kommentar(er)

0 kommentar(er)